※取引画面がアップデートされている為、動画内容と多少差異がございます。

初心者にも分かりやすく高収益が見込める、それがハイロー取引です。 ハイローはご自身が選んだ銘柄の価格が、判定時間の時点で ▲上昇 しているか、▼下降 しているかを予想する商品です。

予想が正しければ、投資額とペイアウト倍率に応じた利益を得ることができ、予想が外れた場合は投資額の損失となります。仕組みを容易に理解し取引することができる、初心者にもおすすめの投資商品です。1取引500円から。

★取引プラットフォームの特徴

- 同値で判定時間を迎えた場合、投資額が払い戻されます。 ファイブスターズは同値終了が負けになりません。

- ペイアウト倍率が高い代わりに、不利な価格で取引が開始される、スプレッド取引はございません。

- 業界最高峰の高いペイアウト倍率

- チャートは、ライン、ロウソク足、エリア、四本値に対応。

- インジケーターは、SMA、RSI、ボリンジャーバンド、MACD、その他計24種類に対応。パラメーター変更可能。

- 足はティック~週足まで10種類から選択可能。

- 土日の週末取引に対応(ビットコイン他暗号資産)

- 登録不要のクイックデモを実装。

限定されたリスク

事前にペイアウト倍率が明示されており、負けてしまった場合のリスク(損失)も投資額に限定されますので、資金管理が容易です。FXや株などのような「含み損」や「塩漬け」がなくストレスがありません。

簡潔性

必要なのは方向感覚、すなわち判定時間までに価格が上がるか下がるかの二者択一です。判定時間で自動的に取引が終了となりますので決済や損切のタイミングを考える必要がありません。

リターンの魅力

予想が正しかった場合は、たとえそれがほんの僅かな差でもペイアウト満額を受け取ることができます。これは利益性において、株やFXとの大きな違いです。

定時制

基本的に24時間取引が可能ですので、複数の時間枠でトレードすることができます。絶えず新たな投資機会がトレーダーにもたらされます。

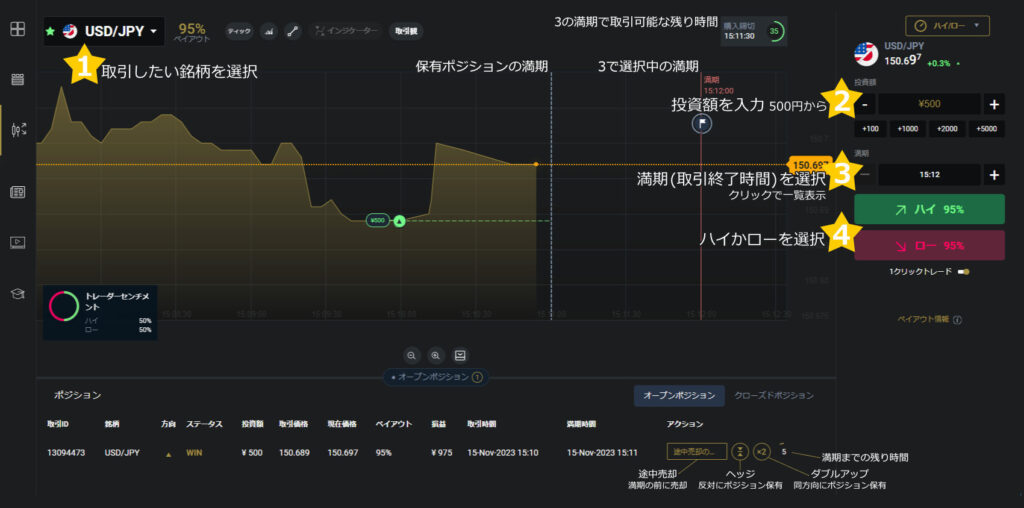

ハイロー お取引手順

画像クリックで拡大表示

USD/JPY、ビットコイン等、取引したい銘柄をお選びください。 銘柄一覧から、隣の星印★にチェックを入れると、次回より一覧の上位に表示されるので便利です。

お取引可能な銘柄や判定時間(取引終了時間)は、相場状況等により変動致します。 常時、すべての銘柄、全ての判定時間(1分、2分、5分等)がある訳ではございませんので、 お取引画面より選択可能な、銘柄・判定時間をお選びください。